The Experior Financial & AOG THE REAL STORY

Your Journey. Our Expertise.

Your Legacy Program

Unlock a 10 time Buyout on Your Insurance Business

Are you looking to Retire and not seeing light at the

end of the tunnel? NO help from Your

IMO or MGA

TAKE TIME TO CHANGE YOUR LIFE

Why Deal With

The Chamberlain Experior Group

Chamberlain Experior Group has over 35 years of industry leadership, providing us with the experience and expertise to help you achieve your financial goals. We offer:

1) Personalized Wealth and Estate Planning to ensure that your financial future is secure.

2) Innovative Financial Tools (4 Fundamentals )

3) Committed to Your long term success

For new advisors, we provide : Dedicated mentorship to help you succeed in the industry, and

For Veterans looking to retire, we offer :

Support to ensure a smooth transition and have a contractual 10 x Buyout based on 75% of you annual renewals

With our trusted approach, we empower both advisors and clients to achieve more together.

Get in touch!

- Fill out the form below and a member

of our team will get back to you.

TESTIMONIALS

What Our Clients Have To Say

Bill Chambers commented to me

"The thing that caught my eye was this Legacy Program that is offered to brokers like me is next to none in the industry , There's nothing like it when it comes to retirement time"

Jeff Neilson as well offered these comments

The process of you transitioning and selling that happens and if I pass away the kind of succession planning that I have in place personally is not enough and after our assessment Jim you showed me that this IMO has an unbelievable Legacy Program"111

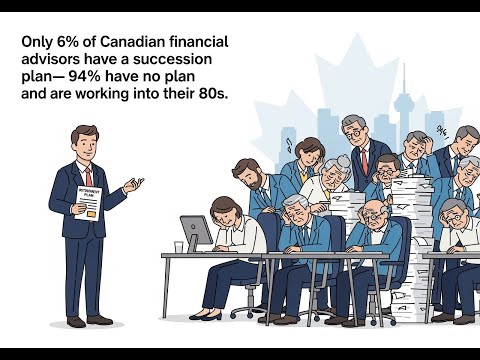

What does a ten buyout look like?

It's a game changer for those

looking to retire in the next 5 to 10 years

How do I know which plan is right for me?

Jim offers and provides personalized

Strategic Assessment to asses your

needs for your retirement plans

What are the requirements?

The three things which are covered in the video

What does this program cost?

An open mind, wellness for change,

a vision for retirement!

Why Choose Chamberlain Experior Group?

35 years in the Industry, 22 years as a manager for 2 large insurance providers. We are looking to work with agents that want to succeed in building their practices. and new individuals that are looking to get into this amazing industry for the first time.

WHO AM I

Struggling to achieve your goals? Discover why you're falling short and, more importantly, how to fix it. In this video, we explore the critical questions you need to ask yourself: Who are you? What’s holding you back? And why not YOU? Learn the importance of self-definition, seeking support, and embracing the mindset shifts needed to turn your aspirations into reality. If you’ve ever wondered why success feels out of reach, this is the motivation and guidance you’ve been waiting for. Watch now and take the first step to achieving what you truly deserve!

Considering a career in the Insurance Industry?

Empower Yourself to thrive in the insurance REALM

MORNING MARKET MINUTES

LET'S WORK TOGETHER

Contact us via phone or email:

(William Edward James )

Jim Chamberlain PFP,CEA,CSC

Senior Manager

195 3015 5 Ave Ne Calgary AB T2A6T8

wchamberlain@experiorfinancial.ca

- 587.952.2466